Ecommercestrategychina.com uses cookies and other technologies to provide you a better browsing experience. You can get more information regarding the use of cookies, or decline it whenever by clicking Privacy Policy. By using this site or clicking “Okay”, you give us the consent to the use of cookies.

OKAY

On August 15, Tencent reported second-quarter financial results, which was negative given a shrinking market and sluggish game growth. Will the overseas business become a new growth area for Tencent? Let's take a comprehensive look at Tencent's overseas strategies, including international WeChat, overseas version of games and global investment.

WeChat in the overseas market

WeChat launched in early 2011, accumulating 200 million Chinese users in less than two years. In 2012, Tencent considered whether it should begin with the internationalisation of WeChat. In 2013, WeChat achieved a major breakthrough in overseas expansion in the United States.

"For Tencent to operate globally, WeChat is by far the only product that realises it," said Pony Ma at the 2013 Shenzhen IT leaders summit, “and the opportunity for WeChat to successfully do international business is 50%.”

In order to achieve 50% of the chances of success, Tencent has made great efforts and provided WeChat with an internationalised budget of RMB 2 billion.

WeChat has even enlisted football superstar Lionel Messi as its global face. But celebrity endorsements do not work well in the United States, nor in football powerhouses such as Brazil and Colombia. Despite the huge investment, WeChat is still only a communication tool for overseas Chinese.

The main reason for the poor performance of WeChat in the United States is the lack of localisation. The WeChat product team and the overseas localisation team are separate, hampering its approach to meeting local user demand.

The gap between cultures and user habits is much wider than Tencent might think. Even many Singaporeans and Taiwanese who are fluent in Chinese are not used to WeChat. Although Whatsapp has not been adapted to local markets, its ease of use has made it successful in various markets.

Tencent also tried to promote WeChat payments overseas, as in Malaysia, but usage growth has been slow. In researching the design of overseas payment services, Ant financial is way ahead of Tencent.

Tencent overseas games’ performance

Tencent's second profitable project after WeChat is mobile games.

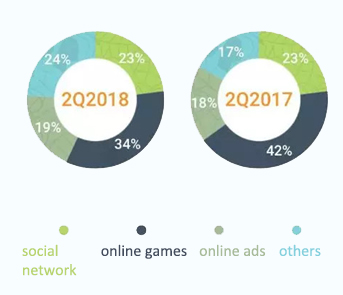

(The performance of the games, which contributed to Tencent’s total revenue, is down in 2018 compared to the same period last year.)

The growth of mobile games in China is slowing down. The domestic market grew by 30 percent in 2017 and is expected to grow by only half in 2018. This means that the overseas market will become a battlefield for the domestic mobile games industry to explore their market and sales opportunities.

Comparing some download rank lists, Tencent’s most successful game overseas at present is the mobile game “PUBG”, which has an absolute download advantage, and its daily active overseas users have reached 15 million. But "PUBG" has not yet contributed to revenue. And the most popular domestic mobile games "Arena Of Valor" and "Monster Castle" are not particularly successful overseas.

Overseas investment by Tencent

After the failure of WeChat’s overseas expansion, Tencent recognised the difficulties of globalisation. As a result, investments and acquisitions have become Tencent’s key international business strategies. The following four aspects are at the heart of Tencent’s current overseas exploration.

Already in 2012, Tencent became the second largest shareholder of KakaoTalk, South Korea's largest chat software. In 2016, Tencent invested in the Indian instant messaging app Hike Messenger and in 2017 Tencent acquired around 12 percent of SnapChat’s stock equity and became a "nonvoting" majority shareholder.

Tencent's biggest gaming investment is in the gaming giant Supercell. In 2016, a consortium comprising Tencent, Softbank, China Investment Corporation and a Canadian pension fund acquired 84.3% of Supercell through an investment of $8.6 billion. In the end, Tencent achieved indirect control of Supercell through consortium majority control.

It is Tencent's biggest overseas investment to date. However, Supercell did not release any new games in 2017, and profits have declined 25 percent in 2017 over the previous year, and revenue has dropped 14 percent, according to the data.

In addition, Tencent has also invested in many well-known game developers and mobile gaming studios, such as SEA, Riot Games, Outpark, Tapze, playdots, Pocket Gem, Robot Entertainment, VC Mobile Entertainment, Artillery, Paradox Interactive, Glu Mobile, Miniclip SA, PATIGames and CJ Games.

On the e-commerce side, Tencent is one of the major shareholders of the Indian e-commerce giant Flipkart, which was bought by Wal-mart for $16 billion this year. In Southeast Asia, Tencent invested in Garena, whose mobile e-commerce business Shopee is Alibaba’s Lazada’s biggest competitor.

In terms of travel, Tencent invested in Ola in India and Go-Jek in Southeast Asia. By the end of 2017, Ola had surpassed Uber’s market share and seems to be better than Uber in terms of a combination of operating cities, multiple services and so on.

Conclusion

Despite WeChat’s recent failure to open overseas markets and weak performance in games, Tencent overseas edition of "QQ music" JOOX is consistently ranking top of downloads of the same type of apps in Southeast Asia.

JOOX is an online music application launched by Tencent for overseas markets and was first released in Hong Kong. At that time, Apple Music, Spotify, KKbox were already in the Hong Kong music market, but all were paid apps. JOOX set it as a free app to reach users quickly, and then introduced the VIP paid mode. JOOX did the same in Southeast Asia and quickly became the No.1 streaming music app in Malaysia, Indonesia, Thailand and elsewhere.

Unlike its competitors, JOOX has added features such as custom skins, accurate recommendations and social account logins. These improvements in user experience are similar to the strategy QQ used when it competed with MSN Messenger in the past. During that time, QQ gained most users with small innovations like screenshots and group chats. Perhaps its performance in JOOX will be the breakthrough for Tencent’s internationalisation in the future.

Please Login to add comments.

$9.99 $19.98

$9.99 $19.98

By GRLpGpAG December 7th, 2023

555

By GRLpGpAG December 7th, 2023

555

By GRLpGpAG December 7th, 2023

555

By GRLpGpAG December 7th, 2023

5omgSfVg

By GRLpGpAG December 7th, 2023

-1 OR 2+335-335-1=0+0+0+1 --

By GRLpGpAG December 7th, 2023

-1 OR 2+24-24-1=0+0+0+1

By GRLpGpAG December 7th, 2023

-1' OR 2+128-128-1=0+0+0+1 --

By GRLpGpAG December 7th, 2023

-1' OR 2+583-583-1=0+0+0+1 or 'rAHKW679'='

By GRLpGpAG December 7th, 2023

-1" OR 2+975-975-1=0+0+0+1 --

By GRLpGpAG December 7th, 2023

if(now()=sysdate(),sleep(15),0)