Ecommercestrategychina.com uses cookies and other technologies to provide you a better browsing experience. You can get more information regarding the use of cookies, or decline it whenever by clicking Privacy Policy. By using this site or clicking “Okay”, you give us the consent to the use of cookies.

OKAY

Introduction

E-commerce has been a hot topic in previous years, while blockchain has only recently become a groundbreaking innovation. These two novelties offer a huge scope for the imagination. What will happen if the two are combined, and how will blockchain act as a platform for the e-commerce sector?

Overview

1. Briefing on the global e-commerce industry

2. The challenges facing online businesses in terms of payment

3. Why you should accept cryptocurrency in your e-commerce store?

4. Effect of blockchain on e-commerce

Briefing on global e-commerce industry

Fifteen years ago, America took the lead in online payment with abundant credit cards available in the country. Now, China has overtaken America in this area with Alipay and Wechat Pay. But who will lead the mobile business world in the next 10 years is hard to predict.

China’s online retailers between 2003 and 2004 were often stuck with the payment problem, which was more difficult to manage than other parts of e-commerce, such as logistics and information flow. At that time, users had to pay by bank transfer when shopping on Taobao, and the process of completing an order was time-consuming. Some experts suggested imitating the US mode, which at that time had a credit card penetration rate of over 60% and was established as one of the world’s leading providers in the online payments market. As a result, banks made great efforts to issue credit cards.

However, it is now believed that China had already overtaken America after years of development, and provided a perfect solution to solving payment problems, thanks to two amazing inventions, Alipay and Wechat pay, which had fundamentally changed people’s payment habits. As shown in the chart, China’s share of global e-commerce is the sum of the other five top countries. Why? People kept asking.

This development can be explained with so-called ‘backwardness advantages’. In the past, China Union Pay required all the banks to connect to a uniform interface since there was neither a basic payment platform nor a health payment environment. And in this way, the cost of the gateway was greatly reduced. Even now, the cost maintains less than 0.001RMB. On the other hand, we should be aware that cryptocurrencies are tightly regulated in China and their further development is more restricted by the government more than in any other country. A bold prediction is that over the next 5 to 10 years, China might be taken over by those committed to researching digital currencies and blockchains.

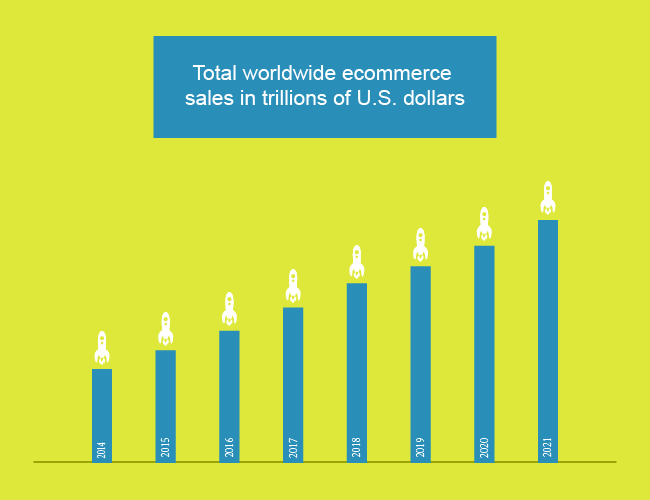

Total worldwide e-commerce sales in trillions of U.S. dollars

The 10 largest e-commerce markets (by billion USD)

The challenges facing online businesses in terms of payment

The number of commercial banks in the U.S was once 140,000. It is indeed true that ‘anyone can run a bank there’, if they have a specific license. In 1982, as the Internet started to flourish, a large number of banks appeared, but many of them soon disappeared due to mergers. After the Internet became widespread, the competition became more intense as they were able to do business in different regions. Today, there are about 3,000 banks in America, most of which were born in the 1970s and 1980s with a solid infrastructure base on. They are different from Chinese banks – they do not need to worry about the ‘single standard’.

There are several types of payment methods in the U.S ranging from cash, online payments, cheques, bank transfers to cryptocurrencies. Even cheques, seemingly the most convenient payment instrument, have to undergo a complicated procedure that involves checking, accounting and billing, taking two to three days to complete and causing high loss costs. Therefore, it is difficult for Chinese companies to succeed in the overseas market – because the existing infrastructure in China’s online payment solution is not conducive to the development of the overseas market.

But how does e-commerce make profits in China? Above all, the rapid growth of the Internet has stimulated Chinese e-commerce, which rose from 0% to 70%-80%. Second, rents and premiums in China are extremely high. Retailers in Beijing had to set a realistic price, which was usually 3 to 5 times higher than the cost price, or they would hardly make a profit. When the rent is low, the goods cost almost the same online and offline, the gross margins of the e-commerce industry will be 3% to 4%, and the e-commerce dividend is unlikely. That is the biggest problem Chinese e-commerce companies face when they are pushing for foreign markets.

So how should they solve this painful dilemma? The best option would be digital currency, because, although the infrastructure costs in Western countries are low, the exchange rate may change abruptly. Digital currencies and cryptocurrencies will be a payment trend, with the benefits of low service fees, real-time transfers and access to global business.

Effects of blockchain on e-commerce

Besides cash flow, blockchain plays an important role in the logistics and information flow. CyberMiles, the first global public blockchain to help improve e-commerce, is a good example.

They manufactured a virtual machine, created intelligent contracts based on the business scenarios, and created their own high-level language. They also used Orcale to extend the execution time. The head of CyberMiles said that blockchain was essentially a slow distributed storage system, and although many public chains boasted their advanced electronic data processing systems, they are impossible to implement with the current technology. CyberMiles specialises in e-commerce and will be online this September. So far, it has provided tests for dozens of excellent companies as well as the developers at Alibaba.

Blockchain is known for its low service fee, but it will never be completely free because that would clog up the blockchain. Ten seconds is enough to ask for confirmation online. In other words, price fluctuations within ten seconds are acceptable, but such a standard does not apply to the financial industry. Each blockchain has its own characteristics, and in the future it is expected that different types of public blockchains will serve specific industries instead of one for all.

Please Login to add comments.

$9.99 $19.98

$9.99 $19.98

By JWL Merticular May 31st, 2018

During my last almost two weeks trip to China early this year, invited by my Chinese friend, I had registered a WeChat account to try their WeChat Pay. Paying with digital currency is actually fast and convenient in the Chinese daily life, no matter it is in the downtown or urban cities. People there can buy anything they want just by scanning and pay with the QR code in their WeChat account. Anyone here can explain that how the Chinese merchants do business on the wechat? I saw there had been many discount coupon shopping on it, but I didn't know how they made it.

By Brinksley Hong June 5th, 2018

The column is very useful for me to understand the latest technological trend.