Ecommercestrategychina.com uses cookies and other technologies to provide you a better browsing experience. You can get more information regarding the use of cookies, or decline it whenever by clicking Privacy Policy. By using this site or clicking “Okay”, you give us the consent to the use of cookies.

OKAY

Pinduoduo is threatening Alibaba’s monopoly in e-commerce

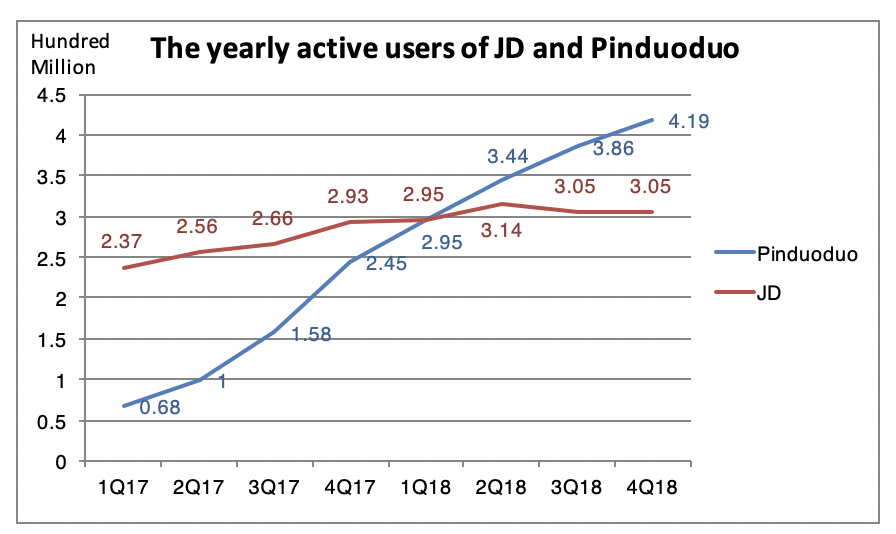

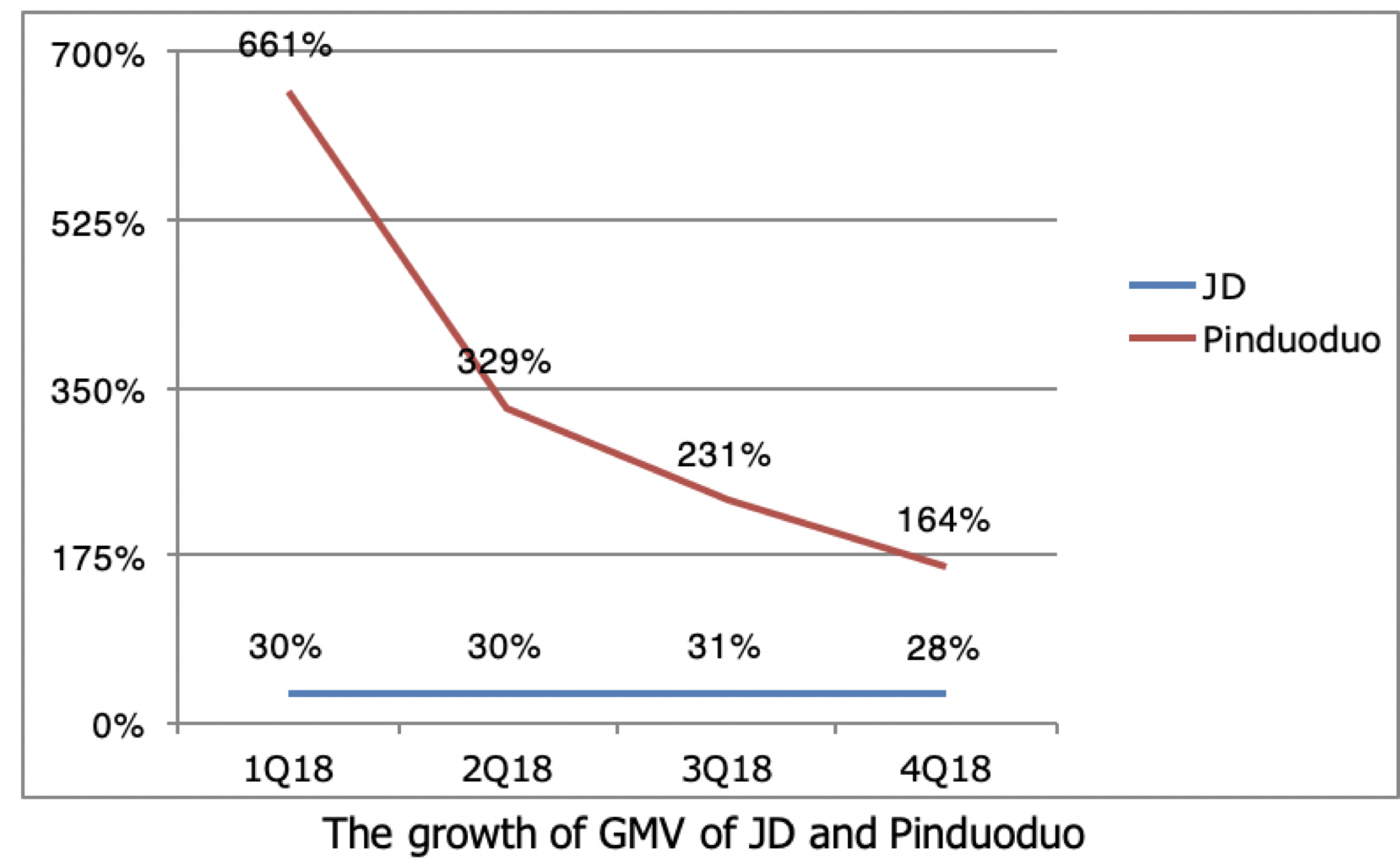

Alibaba and JD are widely regarded as dominant powerhouses in China’s e-commerce market. But since Pinduoduo emerged as a black horse growing in lower-tier areas with the Groupon model, the situation seems to be changing. According to Pinduoduo’s 2018 financial report, there were 420 million active buyers in the second quarter of 2018, compared to JD’s 310 million. Not only that, Pinduoduo quickly pulls users away from JD. As reported by QuestMobile, the targeted users of the two e-commerce platforms overlap, which means more and more JD users have started to use Pinduoduo. But what is worse for JD is that this user segment has a higher exposure to Pinduoduo (in terms of usage duration and frequency).

Although JD is ahead in the transaction scale due to higher prices for each transaction (people spend on average RMB 5492 on JD), it is far behind Pinduoduo in terms of gross merchandise volume (GMV). Pinduoduo has experienced phenomenal growth through its pursuit of Alibaba, which had an unassailable lead in the market.

Alibaba’s “defence” against the expansion of Pinduoduo

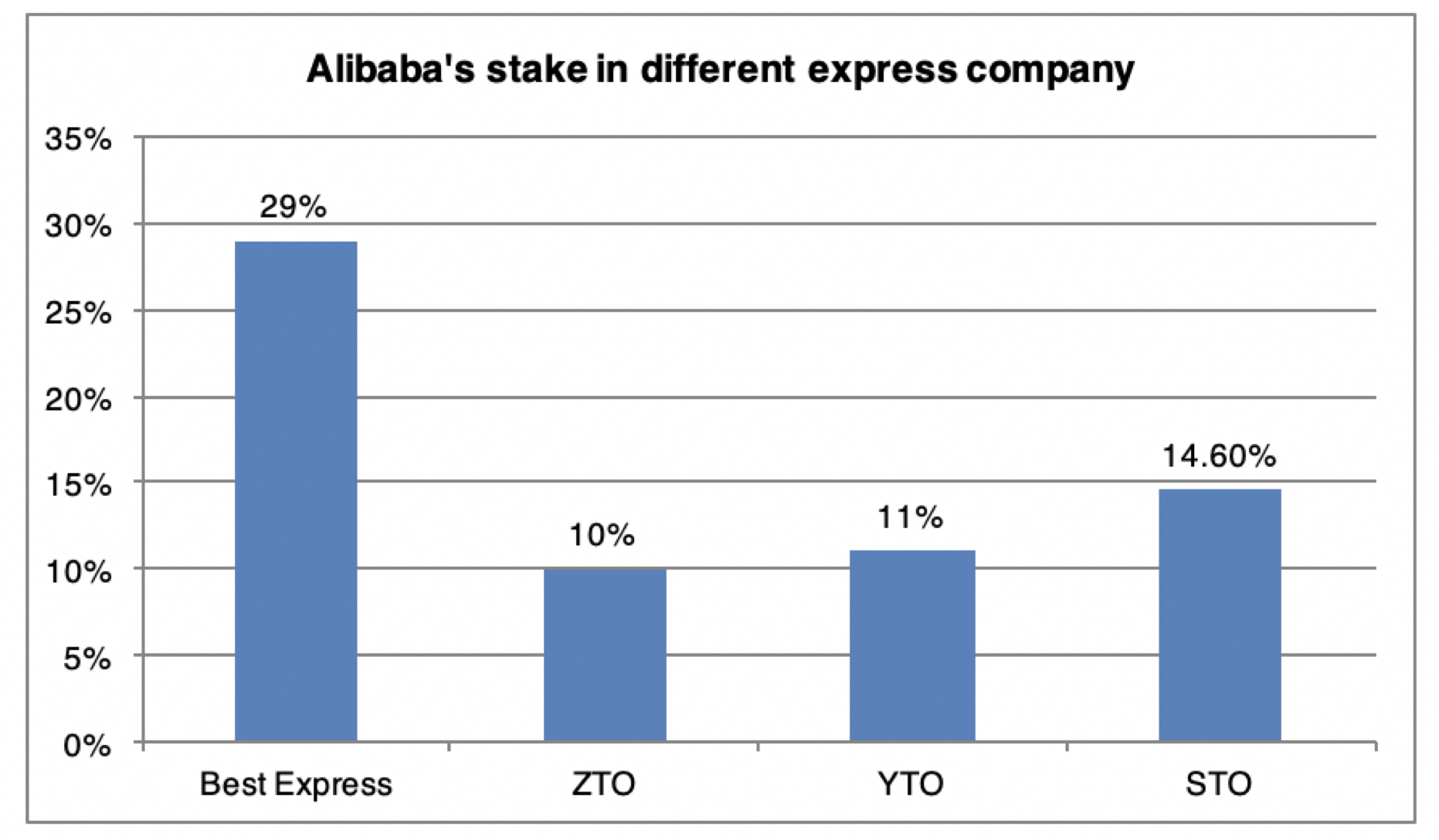

On March 11, Alibaba announced to buy a 14.7% stake in STO, a Shanghai-based courier service firm, for 4.66 million yuan. The investment is a continuation of Alibaba’s initiative to strengthen ties with Chinese courier service giants through cross-shareholding. It already holds minority stakes in three of the country’s top logistics companies: ZTO Express, YTO Express, and Best Express. The push into the logistics industry should not only ensure a more effective delivery experience across China, but also be seen as a defence against Pinduoduo.

In the past, downstream logistic companies, especially the five mentioned above, had to rely on Alibaba for business, as JD has a self-built logistics system. Not anymore. Pinduoudo is now taking this place, generating over 20% of the nation’s logistical requirements and offering them more opportunities. However, this means weaker control of the downstream logistics companies by Alibaba. The one who receives a larger share of orders will win the initiative in the e-commerce market.

Alibaba’s counter plan

In addition to investing in STO, Alibaba has initiated a series of actions to against the rising Pinduoduo. Firstly, Taobao, Alibaba’s C2C marketplace, has launched a “group buying” section to explore the M2C (Manufacture to Customer) business, where it will meet Pinduoduo directly. Besides the low-price strategy, Taobao is dedicated to the simulation of leads through content marketing to target the “sinking users”, the growing group of consumers in lower-tier cities. The live streaming feature contributed to over one hundred million trading volumes on Taobao. To further drive sales through its independent live-streaming app, Taobao has created a special agricultural product division and taken the initiative to employ and train rural Key Opinion Leaders (KOLs) and anchors.

Daniel Zhang, the CEO of Alibaba Group, does not believe that Pinduoduo can survive in the market for a long time because low-price and low-quality products cannot provide the best user experience. Nobody, including Alibaba, paid enough attention to it when it was at an early stage development. Now, however, its exponential rise is creating a sense of threat among the existing e-commerce players. Another challenge for Alibaba is maintaining profitability while expanding business, especially in the case of digital entertainment investment losses (estimated at 15 billion yuan) and the continuation of subsidiary battles between its affiliated local service platforms (including Eleme and Koubei) and Meituan.

Check The Social Media Fever in China

Is Pinduoduo really a threat to Alibaba in the long run?

Pinduoduo started with the low-tier market, so the next step for expansion will necessarily be an entry into the upper market. Massive subsidies have helped attract a large number of price-sensitive consumers in the lower market. At the opposite end, i.e. in the higher market, this may not be as efficient as expected, and marketing costs will most likely need to be increased. It is reported that Pinduoduo spent 6 billion yuan on marketing in the fourth quarter, twice as much as in the previous quarter.

Undoubtedly, the competition between Alibaba and Pinduoduo will continue. Before the war comes to an end, e-commerce retailers must first understand the marketplaces and then choose the appropriate one to address each consumer segment.

Please Login to add comments.

$9.99 $19.98

$9.99 $19.98

By GRLpGpAG October 2nd, 2023

MJ01BaVq') OR 884=(SELECT 884 FROM PG_SLEEP(15))--

By GRLpGpAG October 2nd, 2023

555'||DBMS_PIPE.RECEIVE_MESSAGE(CHR(98)||CHR(98)||CHR(98),15)||'

By GRLpGpAG October 2nd, 2023

1'"

By GRLpGpAG October 2nd, 2023

1�

By GRLpGpAG October 2nd, 2023

@@3hFBl

By GRLpGpAG December 7th, 2023

555

By GRLpGpAG December 7th, 2023

555

By GRLpGpAG December 7th, 2023

555

By GRLpGpAG December 7th, 2023

555

By GRLpGpAG December 7th, 2023

555