Ecommercestrategychina.com uses cookies and other technologies to provide you a better browsing experience. You can get more information regarding the use of cookies, or decline it whenever by clicking Privacy Policy. By using this site or clicking “Okay”, you give us the consent to the use of cookies.

OKAY

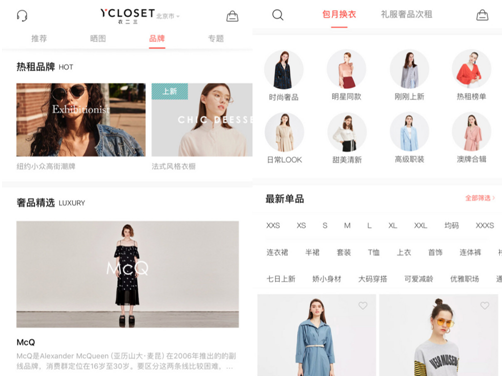

1 - Alibaba invested in a clothes rental platform - YCloset

In September 2018, YCloset (Chinese clothes sharing platform) completed a new round of investment with Alibaba Group and the financing amount was not disclosed. Last September, Alibaba, Softbank China and Sequoia China together invested $50 million in this company.

YCloset, founded in December 2015, provides female fashion rentals nationwide. Users can rent clothes on the platform after becoming a member for no more than RMB 499 per month and up to 3 pieces at a time. Users can also buy the clothes directly after the rental, with the price varying according to the rental periods. Currently, 75% of the platform's revenue comes from membership fees, and rest comes from the sale of clothing.

The items offered on YCloset are mainly "accessible luxury” brands, "commercial” brands, and "designer” brands. There are currently over 500 brands and over 20,000 stock keeping units (SKUs). 20% of the brands are accessible luxury ones like Acne Studios, self-portrait, PINKO, McQ, VERSACE JEANS, commercial brands like Peacebird account for about 30%, and the 50% are the niche designer brands that claims a larger share.

Apart from purchasing the clothes directly before placing them on the platform for rental, YCloset cooperates with the brands and lets them place their clothes rent-free on the rental platform, but shares the profits with the brands through the rental and purchase actions of users. In addition to the revenue, YCloset attracts the clothing brands with relevant user shopping data on the platform, helping brands assess their customer bahaviour and shopping habits. In the future, YCloset plans to co-brand with brands and promote them on the platform, as well as build its own new and independent brands.

Compared to the same period last year, the number of paying users on YCloset has increased by tenfold and the volume of goods in circulation has risen twenty to thirtyfold. The daily average usage of each user is 2-3 times, with an average of 5 minutes each time. And every user buys once a week. According to the data, YCloset performs well in the user growth and maintaining user stickiness.

Alibaba’s second-hand trading platform, Xianyu, officially launched its rental business in the middle of this year. It offers users with a full range of rental services including clothing, mobile phones, household appliances and toys. YCloset will rely on Taobao's ecosystem to acquire more users and brand resourcesthrough platforms such as Xianyu, Taobao, Tmall, Alipay and ZhimaCredit. It is thought that YCloset will in future build a brand shop on Xianyu to sell second-hand clothes.

2 – Alipay is once again entering the Japanese market and is seeking full coverage in Japan by 2020

Ant Financial accelerates its global expansion with a $14billon C round of financing.

To make it easier for Chinese tourists to attend the Tokyo Olympics in 2020, Alipay will work with Japanese partners to accelerate the development of a cashless payment environment and put Alipay into practice across Japan by 2020, said by Ant Financial CEO Eric Jing on September 5, 2018 in Tokyo.

Since December 2015, Alipay has worked with Japanese traders. Alipay is currently very popular in tourist areas, airports, department stores and other places where there are many Chinese tourists. But Japanese locals are more used UnionPay cards and cash payments. Although the cooperation seems to offer convenience to Chinese tourists, it also suggests Alipay’s desire to attract more local users and to support the mobile payment habits of Japanese users.

Over the past two months, Alipay has cooperated with Japanese local financial organisations, such as Hidashin and Kyoto Credit Bank, and will co-work with Line Pay, Paypay and other local mobile payment platforms to reach more small businesses.

Meanwhile, Ant Financial has also proposed a mobile payment strategy "Belt and Road" (B&R). Through B&R, the "local version of Alipay" is loaded in 9 countries and regions along the route, providing services to over 3 billion people worldwide.

3 - Luckin partners with Tencent VS Alibaba allies with Starbucks

Luckin Coffee announced its strategic partnership with Tencent on the afternoon of September 6, 2018. Together, the two sides opened a thematic flash store at Tencent’s headquarters in Shenzhen this April. WeChat has always been an important traffic portal for Luckin. Through WeChat Moments it quickly bringsa number of young users to Luckin.

The partnership will focus on marketing, where Tencent and Luckin will take advantage of each other to jointly promote WeChat payments, explore the intelligent marketing of the WeChat Mini Program and apply various cutting-edge technologies to offline formats. For example, how to provide users with services such as product recommendations and customised menus through image recognition, face-ID payment, robot delivery and AR interaction?

Prior to the partnership, Luckin was just a shopkeeper on the WeChat platform. Now it is the beginning of Tencent's foray into the coffee market. In August 2018, Starbucks announced its strategic cooperation with Alibaba, where Starbucks will not only deliver coffee via ele.me, but also share data or joint members with Alibaba. Meanwhile, the partnership between Tencent and Luckin is also a response to the alliance between Starbucks and Alibaba, which indicates that Tencent’s retail battle with Alibaba will continue in the coffee market.

Coffee brands from other countries also want to join into the Chinese market. Doutor Coffee, Japan's largest chain of coffee shop, opened its first store in Shanghai on August 25th this year. Doutor Coffee has 1,349 stores in Japan, more than those operated by Starbucks. In addition, Java House, East Africa's largest chain of coffee restaurants, is preparing for the Chinese market with Kenyan tea and coffee.

Despite China's huge coffee market, drinking coffee is a long way from high demand in China. How to get Chinese consumers to drink coffee in quantities similar to milk tea is a question coffee brands and giants have to solve.

Please Login to add comments.

$9.99 $19.98

$9.99 $19.98

By GRLpGpAG December 10th, 2023

555

By GRLpGpAG December 10th, 2023

555

By GRLpGpAG December 10th, 2023

555

By GRLpGpAG December 10th, 2023

555

By GRLpGpAG December 10th, 2023

555

By GRLpGpAG December 10th, 2023

zGoiQLdO

By GRLpGpAG December 10th, 2023

-1 OR 2+228-228-1=0+0+0+1 --

By GRLpGpAG December 10th, 2023

-1 OR 2+558-558-1=0+0+0+1

By GRLpGpAG December 10th, 2023

-1' OR 2+734-734-1=0+0+0+1 --

By GRLpGpAG December 10th, 2023

-1' OR 2+373-373-1=0+0+0+1 or 'Te49kwb6'='