Ecommercestrategychina.com uses cookies and other technologies to provide you a better browsing experience. You can get more information regarding the use of cookies, or decline it whenever by clicking Privacy Policy. By using this site or clicking “Okay”, you give us the consent to the use of cookies.

OKAY

For five consecutive years, consumption has had a positive impact on China’s economic growth. According to data released by the local government, the Chinese middle-income population of over 400 million people has been a major factor in increasing consumption and the development in the lower-tier cities is even faster in the lower-tier cities. In this article, we present a recent report on the consumption behaviour and preferences of Chinese women launched by Vipshop (an e-commerce website specialising in online discount sales) and iResearch (a market research and consulting company) to help brands to accurately assess the needs of female consumers and use these insights to achieve success in 2019.

Outline:

Five trends of middle-class female consumption

The consumption differences of female consumers in lower-tier cities

5 trends of middle-class female consumption

As women earn more, they pursue higher consumption and a higher quality of life. This growing group of middle-income women is showing some visible preferences and changes in consumer behaviour, including requirements, recognition, mentality and preferred consumption channels, regardless of regions. Let’s take a closer look at each trend.

They are more attracted to brands and are more price sensitive.

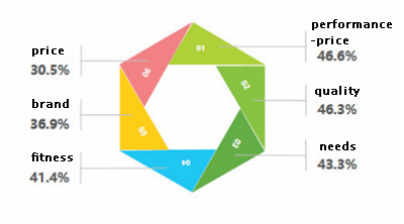

For all the factors that influence the buying decisions of middle-income women, the relationship between performance and price is the primary concern. Then comes the product quality.

About 90% of female shoppers tend to seek out sources of shopping information and advice on shopping by themselves while many get word-of-mouth recommendations from their friends or families or online social circles based on common interests and topics, which has triggered the booming social e-commerce. The low-price strategy of established brands, such as discount sales, has proven to be particularly effective to middle-income groups and is also of great importance in cultivating brand awareness among people in poorer regions.

They have a stronger sense of self-awareness.

With an increase in disposable income, women’s self-esteem increases, causing them to enjoy themselves and follow their feelings, buy what they want and livethe way they want.

They care about personalisation and emotional connection of products.

Middle-class women in China advocate a life of freedom and convenience. Standardised products can no longer meet their personalised needs. Nowadays they prefer niche items with tastes and styles rather than useful ones and are interested in the stories behind the brands. Creative new products are increasingly favoured by this market, and creative marketing in line with brand identity will creates competitive advantages and generates revenue advantages for brands.

“Virtual investment” is growing.

Besides material consumption, they spend a lot of money to enrich their spiritual life through further education, travel or exercise.

The consumption difference of female consumers in lower-tier cities

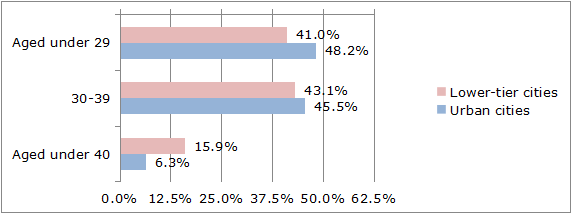

Despite the general trend, the economic disparities and uneven regional development have led to enormous differences in demographics conditions and living conditions in first-tier cities and the less-developed ones, making the female consumer market diverse and unique. For example, most of the middle-classes in first-and-second-tier cities are under 29 years old, which equals 48.2%, while in smaller cities the majority is between 30 and 39 years old.

Regarding the sources of expenditure, there are some similarities. Both mainly consume the necessities of life and services related to social leisure and entertainment. But people in first-and-second-tier cities are willing to spend money on tourism and education while the ones in smaller cities would like to pay more for a healthier lifestyle.

Middle-income women in these areas show both similarities and differences. In this report, we presented three types of middle-income women with different characteristics: the “older” ones, over 30 years old and with children; they are under pressure from family and work, but still stick with their personal ideals; the younger group is either in a better affordability or in pursuit of an exquisite life. Those who live outside of the metropolis spend a lot of money, keep up to date with the latest fashion trends and novelties, and adopt an informal attitude. Many of them have tried to make livings in the digital world by becoming KOLs that share their talents or expertise and monetise their following on social media.

As the market in the major Chinese cities is close to saturation and internet traffic is declining, local businesses have sought opportunities in lower-tier cities and are targeting their middle-income groups, who have above-average consumption potentials than the perceived “elite-classes”. While consumers in the US and other Western countries are starting to reduce their spending due to uncertainty about the future, women in China are confident and ambitious about consumption. The market that targets women, the so-called She Economy, is lucrative. It sounds like a cliché, but mobile presence is a must if you want to reach a consumer segment in China. Brands looking to harness the purchasing power of women need to know how to innovate products and online communications.

Please Login to add comments.

$9.99 $19.98

$9.99 $19.98