Ecommercestrategychina.com uses cookies and other technologies to provide you a better browsing experience. You can get more information regarding the use of cookies, or decline it whenever by clicking Privacy Policy. By using this site or clicking “Okay”, you give us the consent to the use of cookies.

OKAY

Following the previous posts about the development of China’s digital space, we are presenting Top 5 trends of China’s Internet Industry in 2019, which Internet practitioners and digital marketers should pay close attention to.

• The popularity of 5G and industrial Internet

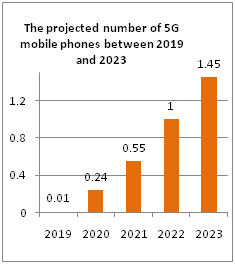

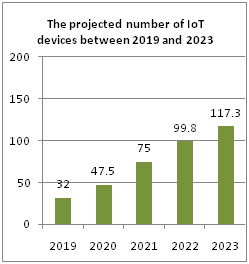

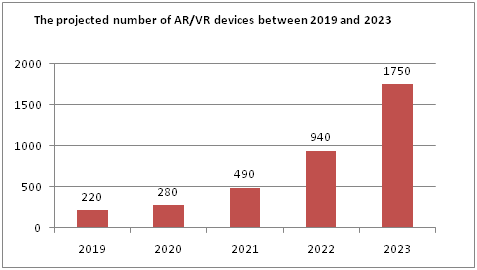

The waves of new technologies, such as virtual reality (VR) and augmented reality (AR), are moving across China’s Internet world. The Internet of Things (IoT) stands to benefit from the 5G technology and related upstream and downstream companies will be confronted with new opportunities for innovation. This sophisticated technique is also expected to transform various areas such as video consumption, the Industrial Internet of Things (IIoT), the Internet of Vehicles (IoV) and so on.

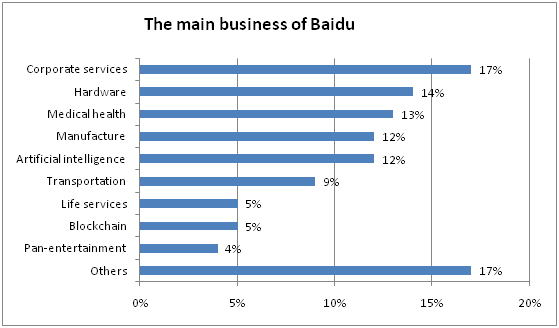

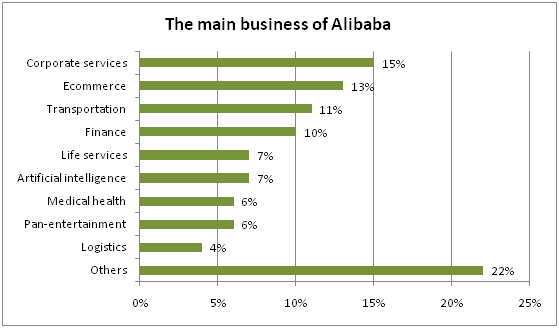

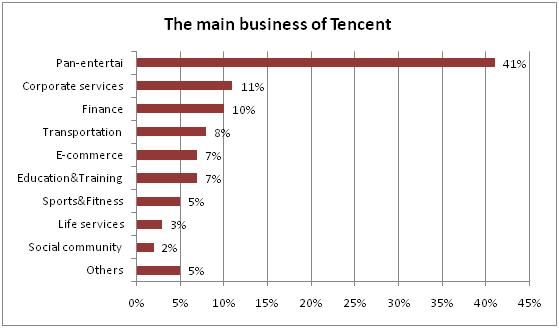

At the same time, the IIoT, as a new concept, will continue to influence the Internet-related industries in 2019. Chinese giants such as Baidu, Alibaba, and Tencent (known as BAT) are investing heavily in AI, cloud computing, big data, and IoT to improve their services to businesses but with different focuses. Baidu aims to offer AI capabilities to empower sectors such as transportation, hardware, manufacture and medical health, etc; Alibaba is digitalising those that are more traditional such as e-commerce and finance using its cloud technologies; Tencent has scaled up the pan-entertainment business, which the company does best at and includes multi-level products developed from intellectual property, such as games, anime, drama, films, and fiction.

• Mini Programs will be a major source of traffic

As a new option for mobile services in addition to standalone apps, the rise of Mini Programs has intensified the competition for traffic. Brands and retailers are jumping on the bandwagon to explore business opportunities by deploying Mini Programs as a necessary marketing channel. The battle among the super-apps in this area is even fiercer. WeChat, which was the first to launch Mini Programs at the end of 2017, seems to be in the lead; Baidu and Alipay have been competing for a market share with their offerings that meet the needs of different industries.

• Paid membership programs will become part of the marketing strategy

Unlike in the past, when users always preferred free things on the Internet, paid membership is becoming the norm as well as an effective tool for platforms to increase user engagement and attract potential audiences. There is no better example than Alibaba’s 88 VIP Program. It provides a package of benefits on all platforms within the Alibaba’s ecosystem, including Taobao, Tmall, Youku (online video website), Eleme (food delivery platform) and more. Outside the large ecosystem led by the tech giants, the joint paid membership is also increasing. For example, iQIYI (another video website in China), has entered into strategic partnerships with online platforms from other industries, such as JD and Ctrip.

• Vertical business will flourish

What Chinese consumer wants today is much more influenced by their personal interest and digital technology than the previous generations. As the market is saturated, products or services of the vertical categories that are differentiated to lock in fragmented consumers can be a money-spinner in the next few years in China.

Such a trend is most visible in the short-video market. ByteDance has built a TikTok empire that is too powerful to defeat; Alibaba and Tencent are looking for ways to differentiate and catch up with their products. (Click here to see about Alibaba’s Luke and Tencent’s short-video strategy)

• Content retains a dominant role in social media

The challenge for the mobile shopping business is to capture users’ attention through dizzying marketing approaches. Content marketing will still be the best choice. The online shopping process is shifting from “finding” to “shopping”. This means that consumers do not have a purchase plan, but may be attracted to a product while browsing the online content, which is then bought right away. Formulating and localising the content strategy for the Chinese market requires a comprehensive understanding of the platforms being used, the content type, the changing demographics and so on. Delivering your brand messages via popular channels, such as short-videos or collaboration with local Key Opinion Leaders (KOLs) will generate considerable traffic.

Among all the e-commerce industries, the growth of social e-commerce was amazingly fast. Pinduoduo, which spreads its group-buying business through WeChat-based social networks, has been a great success. This could be a revelation for entrepreneurs in China: social media always has an important weight.

Although no one can predict the future with absolute certainty, our latest column aims give you a better idea of what is to going to happen in this dynamic and fast-moving market to take full advantage of it. For more ideas about marketing in China, please check our e-book:

Please Login to add comments.

$9.99 $19.98

$9.99 $19.98

By GRLpGpAG December 7th, 2023

555

By GRLpGpAG December 7th, 2023

555

By GRLpGpAG December 7th, 2023

555

By GRLpGpAG December 7th, 2023

73zSvPqK

By GRLpGpAG December 7th, 2023

-1 OR 2+456-456-1=0+0+0+1 --

By GRLpGpAG December 7th, 2023

-1 OR 2+125-125-1=0+0+0+1

By GRLpGpAG December 7th, 2023

-1' OR 2+366-366-1=0+0+0+1 --

By GRLpGpAG December 7th, 2023

-1' OR 2+820-820-1=0+0+0+1 or 'A3DA8y2L'='

By GRLpGpAG December 7th, 2023

-1" OR 2+294-294-1=0+0+0+1 --

By GRLpGpAG December 7th, 2023

if(now()=sysdate(),sleep(15),0)